At Valueraj Associates, we believe regular knowledge is essential to deal with your money needs of now and of future as well. This knowledge can be nurtured through fun also.

Despite none of your faults, your money keeps losing its purchasing power because of its invisible enemy i.e. inflation in the economy. The only way to preserve/grow the purchasing power of your money is to invest it in assets yielding variable returns rather than fixed returns. For example, if invested in stocks (or stock funds) for long-term, your money can generate returns that are sure to beat inflation. Stocks (or stock funds) are risky in the short-term but safe in the long-term! Find above a comic strip on this and we hope you enjoy it.

We wish you and your family a happy, healthy and wealthy 2026.

At Valueraj Associates, we believe regular knowledge is essential to deal with your money needs of now and of future as well. This knowledge can be nurtured through fun also.

Loans are like overweight of your body. Easy to get but difficult to get rid of. So, instead of paying back any loans over long periods, you should consciously pay them back as soon as you can. Only when you are freed from loans/EMIs, your cash flows will improve and make you feel rich. In fact, feeling rich does not depend on whether your income is high or not. It rather depends on whether you are debt-free or not! Find above a comic strip on this and we hope you enjoy it.

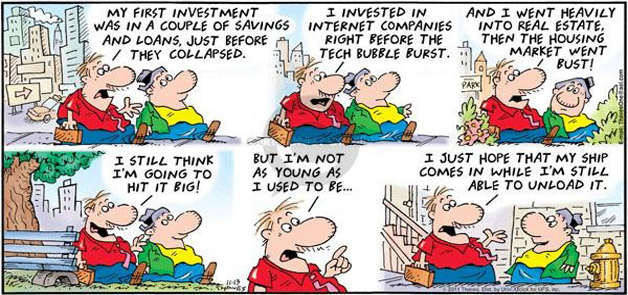

At Valueraj Associates, we believe regular knowledge is essential to deal with your money needs of now and of future as well. This knowledge can be nurtured through fun also.

As year 2025 is coming to end, it is time to reflect on your investments. In Investing, the default rule for making profits is to avoid crowded investments. If you follow the fancy of crowds, you will only become old, not rich! Develop and follow your own anti-crowd style of investing. This in turn keeps you fearful when others are greedy and also makes you greedy when others are fearful! Find above a comic strip on this and we hope you enjoy it.

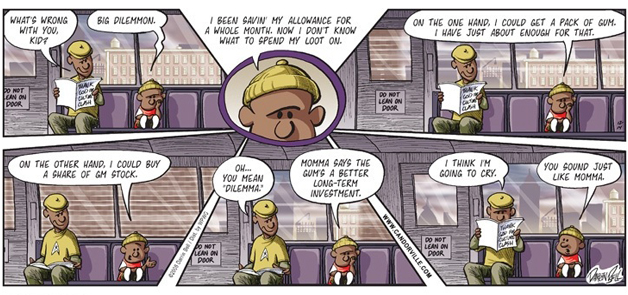

At Valueraj Associates, we believe regular knowledge is essential to deal with your money needs of now and of future as well. This knowledge can be nurtured through fun also.

The key to becoming rich is, firstly, you must generate regular savings during your working years and secondly, invest those savings in high-risk, high-return investments such as stocks or stock mutual funds. It does not matter whether your income is low or high. What matters is whether your expenses are much lower than your income or not. In fact, you must optimize your expenses and generate as much savings as possible for investments. Or simply, you must invest first and then spend the rest! Find above a comic strip on this and we hope you enjoy it.

At Valueraj Associates, we believe regular knowledge is essential to deal with your money needs of now and of future as well. This knowledge can be nurtured through fun also.

Spending your money is not a sin as long as you feel good about it. But, if you borrow and spend for some instant gratification, you may feel bad about it sooner or later. So, in this festive season, use only debit cards for all your shopping and spend only what you can afford. If you use credit cards, be conscious of spending and payback all the balances promptly.If your paybacks are not prompt, penalties are absurdly high in credit cards! Find above a comic strip on this and we hope you enjoy it.