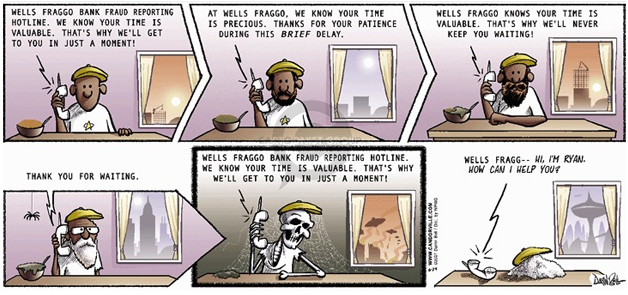

Currently, our news media is full of pessimism about global economy, currency and stock markets. However, do note that economic slowdowns and bear markets are natural and temporary in capitalism. If you are a long-term investor in stocks or stock mutual funds, you shouldn’t get carried away with this news flows. You just take them in stride and stick to your Financial Plan. Eventually, you will be rewarded with superior post-inflation, post-tax returns on your investments to fulfill your goals.

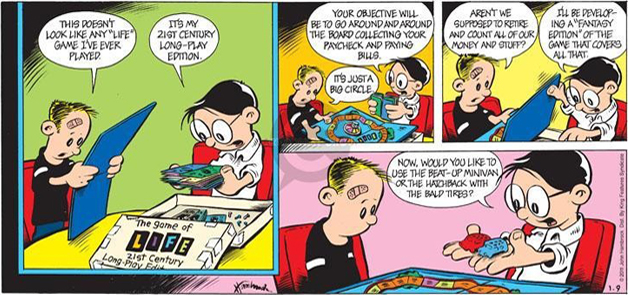

Unlike in the past, there are plenty of savings / investment / insurance products in the market now. Indeed, these are times when we are confused because we have too many choices. Financial Planning is a process by which clarity is achieved from this confusion. It guides you in selecting right products to meet all your financial goals in future. Financial Plan is like a roadmap for your future finances. Get it done and follow it for peace in your life.

When it comes to Financial Products, it is more important to know what not to buy rather than what to buy. One simple thumb rule is, whenever you buy any insurance/investment product, you should do mental mapping of it to meet your family’s financial needs in future. Those needs include children’s education, retirement, health-care, disablement etc. If you can’t map it to any need, but if you still buy it for other reasons like saving taxes, you will be committing a mistake. Few such mistakes can cost you peace of mind in future as you will end up in fire-fighting to meet your needs then!

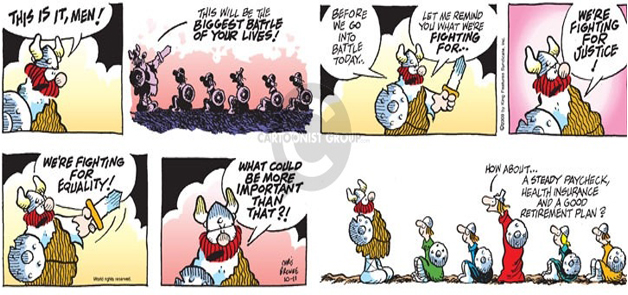

When it comes to managing your personal/family finances, it is not as easy as preached by pink papers, money magazines, business news channels and blogs. If you have a full-time job to do, you may have to sacrifice your week-ends and after-office hours to learn about personal finances. Only when you develop it as a serious hobby, you will be able to manage your finances well and good. If not, you better seek services of a professional advisor and make sure that he not only gives unbiased recommendation on financial products but also responds promptly to your service requests. He should be like a family friend in need!

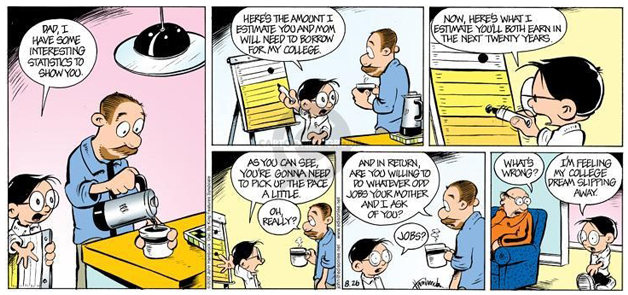

When it comes to children’s education, cost of higher education is increasing faster than parents’ income in our education system. Regardless of whether the institutes/universities are public or private, better the reputation, higher the costs. Hence, it is your responsibility to plan and invest for this future need so as to avoid taking student loans then. If you avail student loans, it is in effect shifting your responsibility to your children and burdening them with loans early in their life!